- The Saturday Shareholder

- Posts

- 3 Short Stories With Investing Lessons: The Tale Of The Painter, Mozart The Mentor, & Charlie Munger's "Hardships"

3 Short Stories With Investing Lessons: The Tale Of The Painter, Mozart The Mentor, & Charlie Munger's "Hardships"

Charlie Munger: "That is a very good idea."

Read Time: 4-minutes

A big thank you to our sponsor for helping keep this newsletter free to the reader:

Money Wisdom focuses on the engine behind your investment portfolio: your income, spending, & savings habits. Money Wisdom shares top money strategies, principles, & frameworks to help you grow your investment portfolio and achieve financial freedom.

Today, we’re going to look at 3 short stories that hold lessons we can apply to investing (& the rest of our finances).

Let’s get started…

The Tale Of The Painter

"The famous seventeenth-century Ming painter Chou Yung relates a story that altered his behavior forever.

Late one winter afternoon he set out to visit a town that lay across the river from his own town.

He was bringing some important books and papers with him and had commissioned a young boy to help him carry them.

As the ferry neared the other side of the river, Chou Yung asked the boatman if they would have time to get to the town before its gates closed, since it was a mile away and night was approaching.

The boatman glanced at the boy, and at the bundle of loosely tied papers and books—“Yes,” he replied, “if you do not walk too fast.”

As they started out, however, the sun was setting.

Afraid of being locked out of the town at night, prey to local bandits, Chou and the boy walked faster and faster, finally breaking into a run.

Suddenly the string around the papers broke and the documents scattered on the ground.

It took them many minutes to put the packet together again, and by the time they had reached the city gates, it was too late.

When you force the pace out of fear and impatience, you create a nest of problems that require fixing, and you end up taking much longer than if you had taken your time."

Slow is smooth, smooth is fast.

This a motto the U.S. Navy SEALS use in their training & operations. And it works well for investing, too.

If we try to rush riches through leverage (debt), speculative investments, or compromising our values to make more income, we're playing with fire…

As Buffett & Munger remind us:

"It's pretty easy to get well-to-do slowly. But it's not easy to get rich quick."

— Warren Buffett

"The desire to get rich fast is pretty dangerous."

— Charlie Munger

— Investment Wisdom (@InvestingCanons)

1:02 PM • Aug 19, 2024

On the other hand, if we focus on methodically spending less than we earn & investing the difference, we're much more likely to reach our destination on time & intact.

Mozart The Mentor

"There's an apocryphal story that is very instructive:

A young man comes to visit Mozart.

He says: 'Mozart, I want to write symphonies.'

And Mozart says: 'How old are you?'

The man says: 'I'm 23.'

Mozart says: 'You're too young to write symphonies.'

He says: 'But Mozart, you were writing symphonies when you were 10 years old.'

Mozart says: 'Yes, but I wasn't asking other people how to do it.'“

Munger explained:

"The truth of the matter is that not everybody can learn everything. Some people are way the hell better.

And, of course, no matter how hard you try there's always some guy or gal that achieves more. My attitude is: 'So, what. Does any of us need to be at the top of the whole world? It's ridiculous.’"

The ultimate lesson: we would do well to focus on our strengths.

Even if our circle of competence is relatively smaller as we begin, we can still focus on what comes easiest to us.

A quote from Munger I included in last week's newsletter that's worth repeating:

"When you play games where other people have the aptitude and you don't, you're going to lose. You have to figure out where you have an edge and stick to it."

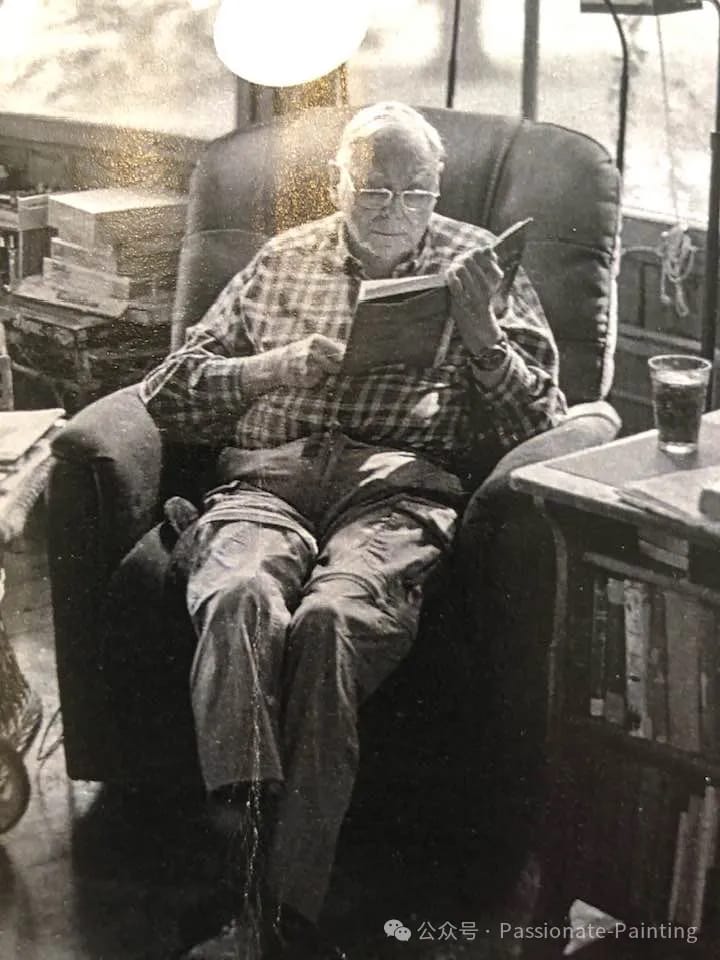

Charlie Munger’s “Hardships”

"My favorite Charlie Munger story:

In 1953, Munger was 29 years old.

Recently divorced. Lost the house. Huge social stigma of divorce back then.

His 8-year-old son, Teddy, was diagnosed with cancer.

The leukemia was incurable.

No medical insurance - Munger paid for all his medical care.

Charlie would visit Teddy in the hospital every day -- and then walk the streets crying.

Teddy died at the age of 9.

Charlie was broke, divorced and just lost his child.

99.9% of people would've turned to alcohol, drugs, or [some other coping mechanism] (And you'd understand why)

Munger never did.

Fast forward to 52 years old, a failed surgery left him blind in one eye with the potential of going fully blind one day.

Charlie was an obsessive learner who read every book he could get his hands on.

When confronted with the possibility of going blind and no longer being able to read he said:

'It's time for me to learn braille!'

The only thing that might be more impressive than his intellect was his actions."

We're not entitled to a smooth experience. To guaranteed results—both in life or our portfolio.

Even if we do all of the work, there are so many things outside our control.

But self-pity isn't going to help us, as Munger explains:

"Every time you find your drifting into self-pity, I don’t care what the cause, your child could be dying from cancer, self-pity is not going to improve the situation. It’s a ridiculous way to behave."

So where do we focus?

On what's inside our control. Our ability to:

Persist.

Seek new opportunities.

Learn new ways of operating.

Munger:

"I think the attitude of Epictetus is the best. He thought that every mischance in life was an opportunity to behave well. Every mischance in life was an opportunity to learn something and that your duty was not to be immersed in self-pity, but to utilize the terrible blow in a constructive fashion. That is a very good idea."

Worth Exploring:

Morgan Housel: Do It Your Way

Shane Parrish: The Ultimate Productivity Hack Is Focus

Nick Maggiulli: Embrace the Uncertainty: On The Benefits Of Upside Surprises

Well, that's it for this week.

I hope you enjoyed these stories & lessons.

See you next Saturday.

Two resources I think you might like:

Book Summaries: One of the most important lessons from Charlie Munger is to strive to become a little bit wiser each day. To accelerate my learning on everything from investing & decision-making to negotiating & habit-building, I use Blinkist (Thank you to the Blinkist team as their affiliate program helps keep this newsletter free to the reader). Blinkist offers easily readable book summaries to help you get the most valuable ideas from the most popular books. You can check out Blinkist here.

Mental Exercises: To paraphrase Morgan Housel, the common factor among elite investors is they have complete control over the space in between their ears. Financial news networks and social media can create a lot of "noise" for investors. To stay focused and calm, I like to use Headspace (I don't receive any compensation from Headspace currently). Headspace offers mindset and breathing exercises to help you keep control over the space between your ears. You can check out Headspace here.

Disclaimers

This material is not investment advice. No responsibility for loss occasioned to any person or corporate body acting or refraining to act as a result of reading this material can be accepted by the publisher. Additional disclaimers here.

How helpful was today's topic? |

P.S. Is there another topic(s) you would like me to cover? If so, reply to this email & let me know—I read & respond to ALL emails.