- The Saturday Shareholder

- Posts

- 7 Steps To Build Investing Habits Like Warren Buffett

7 Steps To Build Investing Habits Like Warren Buffett

Read Time: 6-minutes

A big thank you to our sponsor for helping keep this newsletter free to the reader:

Money Wisdom focuses on the engine behind your investment portfolio: your income, spending, & savings habits. Money Wisdom shares top money strategies, principles, & frameworks to help you grow your investment portfolio and achieve financial freedom.

Today, we're going to look at the 7 steps to build investing habits like Warren Buffett.

Knowing how to build habits is as important as knowing which investing habits to build, which we explored last week (The 5 Habits Warren Buffett & Charlie Munger Recommend to Build).

Because good intentions without a reliable plan of action remain just that—good intentions.

So, today we’ll look at the habit-building principles from New York Times bestselling author James Clear as detailed in his book "Atomic Habits."

Let's dive in.

The Importance Of Habit

First, why are building habits so important? Because small habits compound…

What seems like an insignificant action step today can produce jaw-dropping results when compounded over time:

“The first rule of compounding: Never interrupt it unnecessarily.”

— Charlie Munger

— Investment Wisdom (@InvestingCanons)

9:03 PM • Feb 7, 2024

The power of compounding applies not just to our portfolio's investing returns, but also our investing habits.

With a firm understanding of how to build habits, we can build a powerful investing routine that compounds our efforts over time.

The Nature of Habit

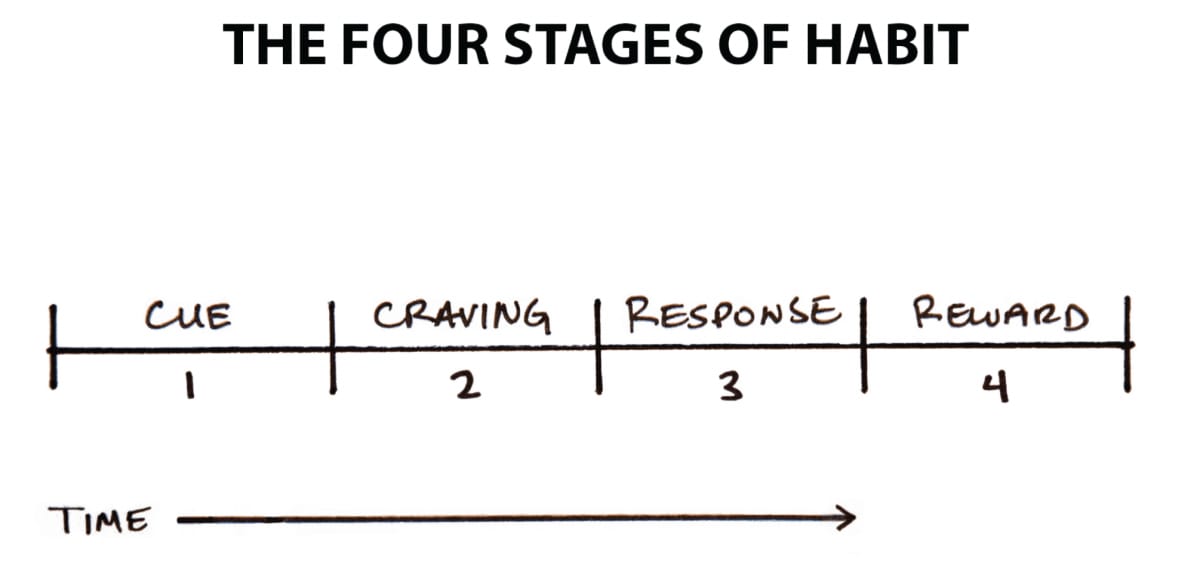

James Clear defines a habit as a behavior that has been repeated enough times to become automatic. He shares a simple 4-stage breakdown for understanding habits: Cue, Craving, Response, & Reward.

We'll look at an example in just a moment. First, at a high level, the Cue triggers recognition of a situation to act. Once recognized, we desire an outcome, aka, we Crave an outcome. So, we activate some sort of a Response in order to get a Reward.

A simple example:

You feel a twinge of hunger in your stomach: the Cue.

This literally creates a craving for food: the Craving.

You make a sandwich: the Response.

Your stomach feels full: the Reward.

Now that we understand the stages of a habit, let's look at 7 steps to building one.

1. Create Clear Cues

Since the first stage of a habit is the Cue, our first priority is to make this cue hard-to-miss:

"Every habit is initiated by a cue, and we are more likely to notice cues that stand out."

Let's say you've decided to start reading 20 pages a day from popular investing books. You started out strong the first day or so, but eventually, other things got in the way.

You could put your book on the table where you eat breakfast as an obvious cue or reminder to continue building your habit.

2. Make “Implementation Intentions”

Clear's next recommendation is to create an "Implementation Intention."

Implementation Intentions have been shown to double & even triple our odds of building our desired habit…

And they're surprisingly simple—here's the formula:

I will [BEHAVIOR] at [TIME] in [LOCATION]

Simply write down your desired behavior and give it a time and place to execute.

"Give your habits a time and a space to live in the world. The goal is to make the time and location so obvious that, with enough repetition, you get an urge to do the right thing at the right time, even if you can’t say why."

So, for example, rather than simply saying "I'm going to read more." Make a specific plan: "I'll read 20 pages of my investing books every day after breakfast."

3. Make the Habit Attractive

“You have to love something to do well at it. It's an enormous advantage if you absolutely love every minute of it.”

— Warren Buffett

— Investment Wisdom (@InvestingCanons)

8:44 PM • Jun 24, 2024

The idea here is to bundle temptations to make important-but-unappealing tasks enjoyable habits.

For instance, if you find reading annual reports relatively less interesting, you can pair it with something you enjoy. Perhaps you play your favorite classical music playlist in the background or light your favorite scented candle as you read.

Whatever it is, making the activity more attractive makes the habit more appealing and sustainable over the long run.

4. Make the Habit Easy

Easy habits get repeated. This shows up in habits we tend to want to curb:

Watching one Netflix episode after another

Eating 1 more potato chip

Scrolling social media

Minimal effort = Easy execution

2 ways Clear says to make your habits easier:

Remove Friction: Let's say your goal is to develop your journaling habit to clarify your thoughts. Putting your journal beside your computer rather than on your bookshelf across the room makes it much more likely you'll journal your thoughts on your next investment idea.

The Two-Minute Rule: Design the task in a way that it can be done in 2-minutes. If you're learning accounting and want to teach it to someone to ensure you actually understand it, commit to sharing a short post on social media. That's much more manageable than committing to teach an hour-long presentation.

///

You’ve made it quite a ways, so you’re probably finding this valuable. Join others who get The Saturday Shareholder newsletter automatically sent to their email every Saturday. Join free here.

///

5. Make the Habit Satisfying

As Charlie Munger recommends:

"Enjoy the process along with the proceeds, because the process is where you live."

This step is one of the most important for investing. Good investing processes & habits may take years to pay off: the market may not recognize the true value of your stock for a prolonged period of time.

So, the key is to make this process more satisfying.

One way to do this:

Focus on the internal metrics of the company. Develop a habit of checking the company’s fundamental metrics each quarter—and minimize excessively checking the stock’s price. After evaluating its quarterly performance, grab your favorite coffee as a reward.

While the market might delay positive feedback in the form of an increased stock price, you can make the process satisfying along the way.

6. Habit Tracking & Contracts

James Clear's next step is to incorporate accountability mechanisms.

First, a tracker to track your habits. Crossing off each accomplished habit doubles as a satisfying exercise (Step #5).

As we covered last week, one of Buffett’s habits is to schedule plenty of time for deep thinking. So, you could create a tracker and mark off each time you attend your scheduled "meeting."

Clear also suggests creating contracts or agreements with others so you experience negative consequences for failing to stay on track.

Implementing this might look like scheduling a 2X per month call with your investing partner. If you fail to show up, you owe your partner $30.

7. Habit Stacking

Finally, James Clear recommends "Habit Stacking":

"The quickest way to build a new habit into your life is to stack it on top of a current habit."

If you're struggling to find time in your schedule to read, you can plan on doing it immediately following a different habit that you've already established. Say, working out.

So, immediately after your workout, you pick up your investing book and read 20 pages.

Habit stacking allows you to leverage pre-existing habits to build new ones.

Conclusion

Those are the 7 steps to build investing habits like Warren Buffett. Let's recap:

Create Clear Cues

Develop a Clear Plan (“Implementation Intentions”)

Make it Attractive

Keep it Easy

Make it Satisfying

Use Habit Tracking & Contracts

Stack New Habits on Existing Ones

Well, that's all for this week.

I hope you found it valuable.

See you next Saturday.

Two resources I think you might like:

Book Summaries: One of the most important lessons from Charlie Munger is to strive to become a little bit wiser each day. To accelerate my learning on everything from investing & decision-making to negotiating & habit-building, I use Blinkist (I don't receive any compensation from Blinkist currently). Blinkist offers easily readable book summaries to help you get the most valuable ideas from the most popular books. You can check out Blinkist here.

Mental Exercises: To paraphrase Morgan Housel, the common factor among elite investors is they have complete control over the space in between their ears. Financial news networks and social media can create a lot of "noise" for investors. To stay focused and calm, I like to use Headspace (I don't receive any compensation from Headspace currently). Headspace offers mindset and breathing exercises to help you keep control over the space between your ears. You can check out Headspace here.

Disclaimers

This material is not investment advice. No responsibility for loss occasioned to any person or corporate body acting or refraining to act as a result of reading this material can be accepted by the publisher. Additional disclaimers here.