- The Saturday Shareholder

- Posts

- The Mentor Of Warren Buffett's Most Important, Versatile Mental Model (& Its 3 Major Advantages)

The Mentor Of Warren Buffett's Most Important, Versatile Mental Model (& Its 3 Major Advantages)

How to Trade 50-cents for a $1-dollar bill...

Read Time: 5-minutes

A big thank you to our sponsor for helping keep this newsletter free to the reader:

Money Wisdom focuses on the engine behind your investment portfolio: your income, spending, & savings habits. Money Wisdom shares top money strategies, principles, & frameworks to help you grow your investment portfolio and achieve financial freedom.

Today, we're going to look at Warren Buffett's mentor's (Benjamin Graham) most important, versatile mental model—and its 3 major advantages.

When Warren Buffett talks about Graham's timeless book "The Intelligent Investor," he mentions 2 chapters to focus on:

"If you pay special attention to the invaluable advice in Chapters 8 and 20—you will not get a poor result from your investments."

Today we're going to begin by focusing on Chapter 20: Margin of Safety.

As Graham put it:

"To distill the secret of sound investment into three words, we venture the motto: Margin Of Safety."

So, let's get started.

How A Margin Of Safety Works

Benjamin Graham explains the purpose of using a Margin of Safety:

"…the function of the margin of safety is, in essence, that of rendering unnecessary an accurate estimate of the future."

Buffett has touched on the dangers of trying to make precise estimates or forecasts:

"Market forecasters will fill your ear, but will never fill your wallet."

Forecasts are fraught with error. It's better to build in a cushion, aka, a Margin of Safety, in our estimate of an investment's price.

So, how does a Margin of Safety work?

Graham explains:

"The margin of safety is always dependent on the price paid. It will be large at one price, small at some higher price, nonexistent at some still higher price."

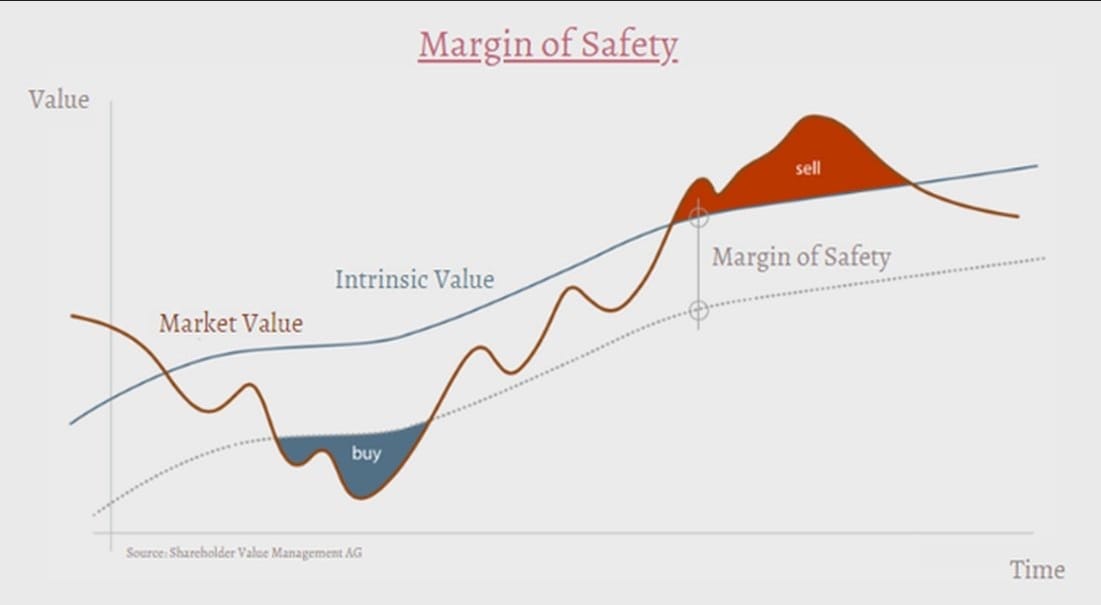

This graphic is a great depiction of this dynamic. The Margin of Safety is the space underneath our estimate of an investment's value, aka, the "Intrinsic Value" that we require before purchasing.

When the Market Value, the price of an investment, is below our Intrinsic Value by a large enough Margin of Safety, that suggests a price at which to buy. If the Market Value is lower than our Intrinsic Value—but not low enough to include a large Margin of Safety—that suggests waiting for the Market Value to drop more.

(And, of course, if the stock's price is above our Intrinsic Value, we do not consider purchasing, but may consider selling any previously-held position.)

3 Major Advantages

When we purchase investments with a Margin of Safety, we do 3 incredibly valuable things for our investments.

The first 2 have to do with the investment's expected payoff:

1. Minimize Risk

First, we minimize downside risk. As Jason Zweig, longtime Wall Street Journal columnist and author of the commentary to "The Intelligent Investor," put it:

"By refusing to pay too much for an investment, you minimize the chances that your wealth will ever disappear or suddenly be destroyed."

And to paraphrase the great investor Joel Greenblatt, if we minimize the chances of losing money, most of the remaining alternatives are good ones.

2. Maximize Upside

Second, we maximize upside opportunity. When Buffett first began applying Graham's Margin of Safety principle, he would buy the stock of companies that were not doing well, but were priced so low that they would still offer great upside.

Graham put it this way:

"It is our argument that a sufficiently low price can turn a security [an investment] of mediocre quality into a sound investment opportunity - provided that the buyer is informed and experienced and that he practices adequate diversification. For, if the price is low enough to create a substantial margin of safety, the security thereby meets our criterion of investment."

Buffett believes investing with a Margin of Safety is like trading 50-cents for a $1-dollar bill.

Simply put, if you can buy an investment with a large enough Margin of Safety, you're doing all you can to maximize upside.

And that's about all you can ask for in investing.

So, a Margin of Safety allows us to minimize downside & maximize upside —that's quite the mental model.

But beyond those 2 benefits, requiring a Margin of Safety arguably has an even more important type of advantage:

A psychological one.

3. Psychological Protection

“Most of the errors in our business are errors of emotion.”

— Howard Marks

— Investment Wisdom (@InvestingCanons)

2:04 PM • Aug 19, 2024

Any edge we can get to manage our investing psychology better and avoid errors can be invaluable.

And when we're highly confident we purchased an investment far below our conservative estimate of intrinsic value, we free ourselves from making all of the typical mistakes that emotional investors make.

2 ways this can pay off:

When the market is slow to recognize how much more our stock should be worth, we're at ease. (And could potentially purchase more shares).

When the market is volatile, we know our initial investment has some protection from our Margin of safety.

So, we're taking a major risk off of the table: behaving poorly.

And while Graham emphasizes the importance of a Margin of Safety within the context of valuing investments, it can be deployed in multiple other contexts of investing…

And knowing multiple contexts to apply a mental model makes it that much more valuable: we get "more bang for our buck."

So, next week we'll look at several ways to use the Margin of Safety concept beyond valuation. Stay tuned.

Conclusion:

That is Benjamin Graham’s (Warren Buffett's mentor) most important, versatile mental model. Let's recap:

A Margin of Safety is a "cushion" that you require against your already conservative estimate of intrinsic value. When a stock’s price is trading at a large enough Margin of Safety below your intrinsic value estimate, that suggests a time to buy. At all other prices, we wait to see if the price will decrease more before buying.

A Margin of Safety has 3 major advantages:

Minimizes downside.

Maximizes our upside.

Allows us to behave better as investors.

Well, that's all for this week.

I hope you found it valuable.

See you next Saturday.

Two resources I think you might like:

Book Summaries: One of the most important lessons from Charlie Munger is to strive to become a little bit wiser each day. To accelerate my learning on everything from investing & decision-making to negotiating & habit-building, I use Blinkist (I’m excited to share I recently partnered with Blinkist. Thank you to the Blinkist team as their affiliate program helps keep this newsletter free to the reader). Blinkist offers easily readable book summaries to help you get the most valuable ideas from the most popular books. You can check out Blinkist here.

Mental Exercises: To paraphrase Morgan Housel, the common factor among elite investors is they have complete control over the space in between their ears. Financial news networks and social media can create a lot of "noise" for investors. To stay focused and calm, I like to use Headspace (I don't receive any compensation from Headspace currently). Headspace offers mindset and breathing exercises to help you keep control over the space between your ears. You can check out Headspace here.

Disclaimers

This material is not investment advice. No responsibility for loss occasioned to any person or corporate body acting or refraining to act as a result of reading this material can be accepted by the publisher. Additional disclaimers here.